Written by Rachael Leinster, Senior Talent Partner

Salary benchmarking isn’t an exact science, but it does allow us as Talent Acquisition, HR, Operations, and People Management Professionals to understand salary trends and market norms for roles that exist within emerging markets, or new technologies, and more fairly and accurately begin to define salaries across the organisation.

The difficulty in effectively benchmarking niche roles is the lack of available data in the public domain, and an increased reliance on company and candidate transparency around salaries. To begin to understand niche roles you will need to have a view of the market more broadly, and be able to bring your experience and anecdotal view into the decision making process.

1. Understanding Salary Benchmarking

The first step of salary benchmarking is the process of gathering data points on salary and overall packages relating to industry, skill, and level. The next, and arguably most important step is to sort and understand the data.

It’s essential for organisations to conduct rigorous benchmarking before going to market with roles. As an organisation you need to understand, agree on, and be comfortable with how you are positioning yourself within the market. Will you be a mid-level payer, high, or even low? This will then help you sort and interpret the data and begin to build a framework for the business.

2. Process of Salary Benchmarking for Niche Roles

The process involved in benchmarking for niche roles isn’t dissimilar to how you would approach benchmarking for a more generalist position, but it will also require a little more leg work and creative thinking!

Imagine you work at a SaaS start-up in Manchester, UK and are doing a benchmarking activity for the Software Engineering team. The nuance being, the team must have experience optimising a specific SaaS product that is only 2 years old.

Think about your team structure:

Do you have multiple levels across the team, or is the structure largely flat. You want to ensure you gather data points across the full spectrum, for example from interns up to CTO.

Begin to gather data of the market more broadly:

Thinking about your industry and the skill set, you would want to look for data points relating to SaaS or Technology start-ups and scale-ups (this will give you a good baseline of border data relating to software developers that are most similar to your organisation).

- Salary guides/whitepapers

- Live job adverts that include salary

- Recruitment agencies on your PSL

- Free online benchmarking tools (google will be your best friend here)

- Job boards with benchmarking data available (indeed, totaljobs, otta)

N.B it’s important to think about the reliability of your sources at this stage - are they a reputable agency, website, or company?

Overcoming benchmarking challenges:

How do we start to include specific salaries relating to the niche profiles the organisation requires?

- Speak to candidates that have the skills you need - even if they aren’t looking for a new role - they will be able to share useful insight into their current packages and expected packages

- Look for specialised recruitment agencies that focus on the skill or industry you need more data on

- If you have access to it, understand the current teams packages and how they differ from their previous roles

- Target companies that are most similar to you, what other organisations use the SaaS product you do?

Do you have enough data:

Ideally, you will want a minimum of 20 data points for each role type and level, this will help to account for any outliers and give you a fairer representation of the overall market.

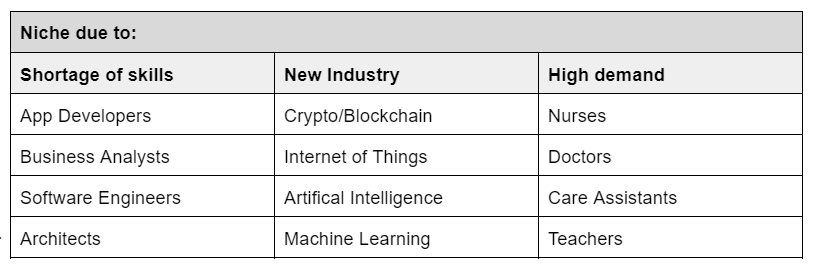

3. Identifying Niche Roles for Benchmarking

What makes a role niche? A job becomes niche when it requires highly specialised skills or knowledge that are not commonly found in the general workforce, and there are a limited number of people who can perform the job effectively. This can be due to factors such as limited availability, high demand, and specialised knowledge.

Example: Below I have provided some examples of niche roles based on Industry, Demand, and Skill (in the UK labour market in 2023).

4. Analysing and Using Benchmarking Data

Understanding your data and building a framework:

Now you have what you need to make data driven decisions you can begin to understand your data

- Cleanse the data - does anything look out of place, or irrelevant (sense check it, and remove it if necessary)

- Choose your maths - will you look at the Mean, Median, or Average of your data points? There are pros and cons to each, and as an organisation you will need to decide which way works best for you

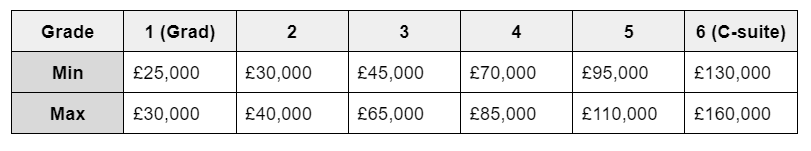

- Use both minimum and maximum bands to build your framework

- Decide where you want to sit (10%, 50%, 100% percentile) and begin to assign bands based off of this

Example: You decide you want to be a mid-market payer across all roles. For this, you would look at the mid-point in the data set (50th percentile) and set the min band for each grade in the team at the 50th percentile, with the max being the 75th percentile.

N.B Percentiles are a useful starting point, but be mindful to take into account industry trends, individual job requirements and/or skills, and the job market. Salary benchmarking needs constant iterations to keep it relevant, so aim to review salary bands across each business unit, team, and role as an absolute minimum - yearly.

5. Conclusion

Salary benchmarking for niche roles can be challenging due to the lack of available data in the public domain, but it's essential for organisations to conduct rigorous benchmarking before going to market with roles. To gather data for niche roles, you need to think creatively and do the legwork, including gathering data from industry sources, job boards, candidates, and specialised recruitment agencies. Once you have the data, it's crucial to clean it and analyse it to build a framework that will help you make data-driven decisions. Remember, a niche role can require highly specialised skills or knowledge, and often there are a limited number of people who can perform the job effectively. With the right approach, you can benchmark niche roles fairly and accurately, helping your organisation to attract and retain the best talent in the market.